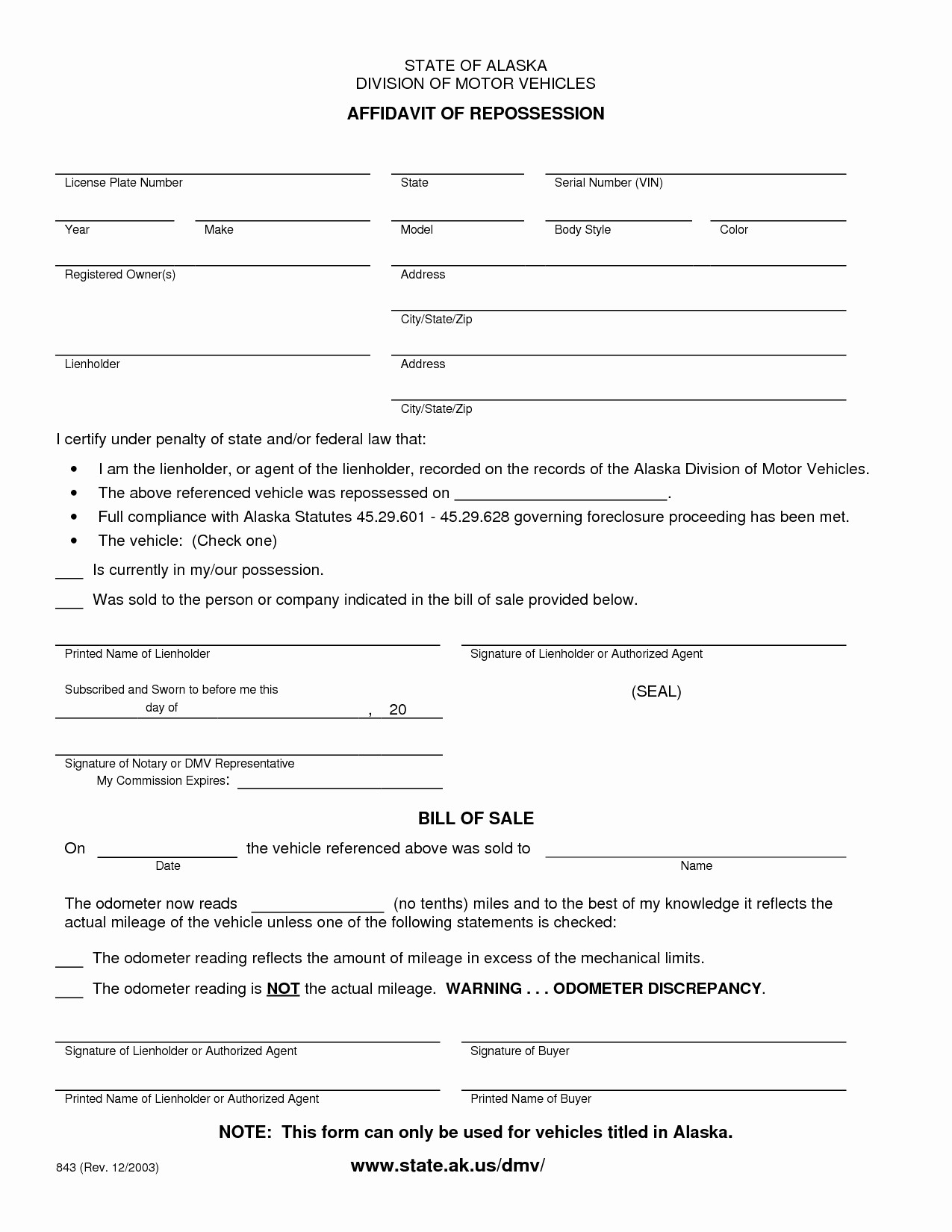

Are you facing the daunting prospect of a car repossession? Understanding your rights and the legal landscape surrounding vehicle repossession is crucial to protecting your assets and navigating a difficult financial situation.

The complexities of car repossession vary significantly depending on your location. Several states, like Tennessee and Florida, operate under specific legal frameworks that dictate how lenders can repossess vehicles and the rights of borrowers. For instance, in Tennessee, lenders are not legally obligated to provide advance notice before taking possession of your car. This stark reality underscores the importance of being informed and proactive in managing your car loan obligations. Defaulting on a car loan, usually after missing one or more payments, can trigger the repossession process. Once a lender repossesses your vehicle, they have certain rights, but you also retain specific options and avenues for recourse.

| Subject | Details |

|---|---|

| Subject | Car Repossession Law |

| Legal Context | Varies by state; lenders' rights and borrower protections differ significantly. |

| Tennessee Law | Lenders can repossess without a court order or prior notice. |

| Florida Law | Lenders can repossess without prior notice after default. |

| Default Trigger | Usually after one or more missed payments. |

| Borrower Options | May include reinstatement, redemption, or exploring bankruptcy options. |

| Legal Claims | Possible if repossession or sale was unlawful. |

| Governing Statute | Varies by jurisdiction. |

| Repossession Process | Once the lender has your car, they can take certain actions. |

| Additional Information | Consult with a legal professional in your state to fully understand your rights and obligations. |

| Relevant Website | Federal Trade Commission (FTC) - Repossessing Your Car |

The actions a lender can take once they have repossessed your car are governed by law. This is where the specifics of state law come into play. In Connecticut, for example, a lender, such as Complete Auto Recovery, might take possession of a vehicle following a loan default. Understanding the precise regulations in your state is important. If you believe your car was repossessed unlawfully, you have the right to explore legal avenues, including potentially filing a claim against the lender. This could be the case if the repossession violated proper procedures or if the subsequent sale of the vehicle was not handled correctly. The advice of an attorney who specializes in debt and consumer protection is strongly suggested if you feel like your rights were violated.

In Illinois, for example, Illinois Legal Aid Online provides resources for understanding your rights in such situations. These resources may cover topics such as how to determine if the repossession was legal, what your options are after the repossession, and what steps to take if you believe the lender violated the law. Additionally, if you are facing repossession, seeking legal counsel is vital. A lawyer can examine the circumstances surrounding your case and provide tailored advice on how to proceed. In some instances, bankruptcy may provide a means of halting a repossession.

Bankruptcy can be a tool. Filing for bankruptcy may trigger an automatic stay, preventing the lender from repossessing your car or taking further action. The choice between reinstating the loan and allowing the bank to keep the car can be difficult. This decision involves careful consideration of your financial circumstances, the terms of the loan, and the potential impact on your credit score. Depending on the situation, it might be wiser to pursue a payment plan or negotiate with the lender, instead of filing for bankruptcy. If you are considering bankruptcy, consult with a bankruptcy attorney to fully comprehend how it affects your situation.

The circumstances in which a car is repossessed differ significantly. In some cases, the lender may have grounds to take possession of the vehicle if payments are significantly in arrears. The specific legal process for repossessing a car varies depending on the laws of the state. In Tennessee, for instance, legislation such as House Bill 2276 can outline the processes involved in repossessing a vehicle. In contrast, Florida law allows lenders to repossess vehicles without prior notice once you default on your loan, typically after missing one or more payments. This highlights the need to be informed regarding the specific laws in your area.

Facing car repossession presents several critical decisions. One fundamental question is whether to reinstate the loan or surrender the vehicle. Reinstating the loan involves bringing the payments up to date, including any accrued interest and fees. This option allows you to retain the car, but it requires a significant upfront payment and does not address the underlying financial issues that led to the repossession in the first place. Consider, the financial implications. If you cannot afford the payments, then you may face another repossession soon after reinstating the loan. Weigh the risks, and be realistic about your ability to pay back the loan.

Another option is to redeem the car. Redemption involves paying off the entire outstanding balance of the loan, including any repossession fees. This is the most expensive alternative, however, it gives you complete ownership of the vehicle. This means you can avoid the negative credit impact of a repossession. As with loan reinstatement, redemption may not be feasible, depending on your finances. As with other courses of action, it is worth consulting with a legal professional. A lawyer can evaluate your financial circumstances and the specifics of your loan, offering advice on the best approach.

The laws surrounding car repossession differ by jurisdiction. Some states, like Florida, operate under specific rules regarding the process. In contrast, Illinois has specific laws governing repossession. The specific laws vary significantly. In Tennessee, lenders aren't required to obtain a court order or give advance notice before repossessing your vehicle. It is important to research the laws of the state in which you reside to understand your rights and duties during the repossession process. If you believe that your car was repossessed or sold unlawfully, you may have legal recourse to dispute the repossession.

The process of car repossession can be a confusing and stressful experience. A lender may proceed with repossession if you default on your loan, usually after missing one or more payments. The lender’s rights and your options vary depending on the laws of the state. If you're facing this scenario, you should start by reviewing your loan documents. These documents will specify the terms of the loan, your payment obligations, and the lender’s rights in the event of default. Make sure you know your rights. Consider seeking legal counsel from a lawyer specializing in consumer finance or debt resolution. They can analyze your case and advise you on the best course of action. Understanding your rights and the legal framework surrounding vehicle repossession is critical to protecting your assets.

Lenders have the right to repossess your car once you default on your loan. The specific procedures and timelines for repossession may vary depending on your location. In Florida, for example, lenders are allowed to repossess your vehicle without prior notice once you default on your loan. This means that your car could be taken at any moment. In other areas, the lender may be required to provide written notice of their intent to repossess the car before doing so. Knowing your local laws regarding repossession is important. This will help you to understand your rights and responsibilities during the repossession process. By understanding the repossession process, you can take proactive steps to protect your rights and minimize the negative effects of a repossession.

Several factors can affect the repossession process. The most important one is the terms of your loan agreement. Review your loan agreement to understand your rights and responsibilities. It is also essential to know your state's specific laws regarding repossession. Some states may require the lender to provide prior notice of repossession, while others do not. There may also be specific rules about how the vehicle must be sold after repossession. Additionally, the amount you owe on your loan, including any late fees or other charges, will also affect the repossession process. The greater the amount you owe, the more likely the lender is to repossess your vehicle. Understanding these factors will help you to prepare yourself for the possibility of repossession and to protect your rights.

A key step in dealing with repossession is to understand the available options. One option is to reinstate the loan by bringing your payments current. Another option is to redeem the vehicle by paying off the remaining balance. Additionally, you may be able to negotiate with the lender to modify the terms of your loan, like lowering your monthly payment or extending the loan term. In some cases, you may even be able to sell the car yourself to prevent repossession. Seek advice from a lawyer or financial advisor to determine the best option for your particular situation.

One strategy to stop repossession is to explore bankruptcy. Filing for bankruptcy may halt the repossession process and give you time to restructure your debts. This could involve reaffirming your car loan or entering into a repayment plan. However, bankruptcy has serious consequences and should be considered only after consulting with a bankruptcy lawyer. Bankruptcy can affect your credit score and remain on your credit report for several years. It is always best to look at all the other available options before considering bankruptcy. Consult a lawyer to know all the pros and cons of bankruptcy.

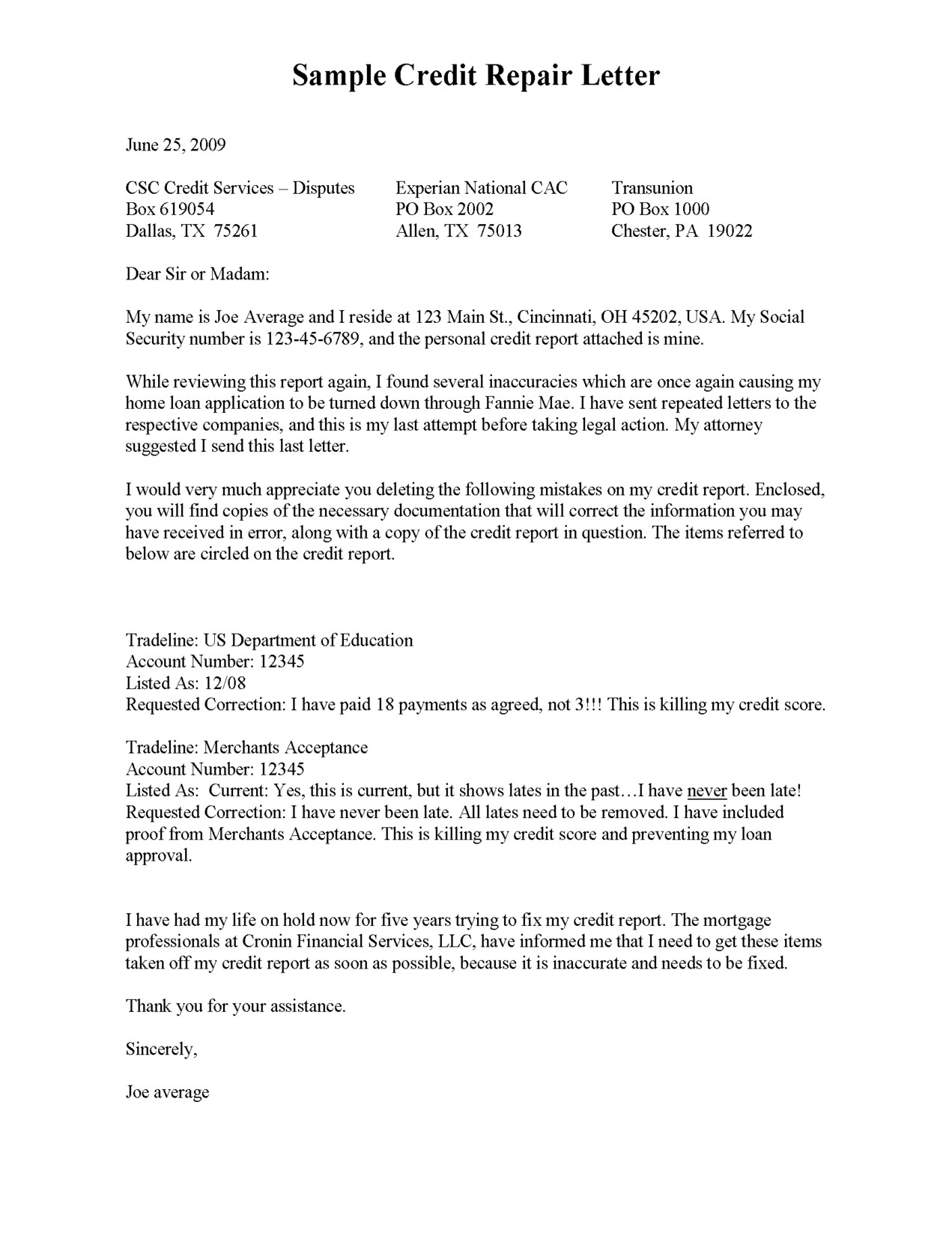

If you believe that your car was repossessed or sold unlawfully, you have legal options. This might involve filing a lawsuit against the lender. An unlawful repossession is one where the lender violated the law, like failing to provide proper notice or repossessing the vehicle without a valid reason. Similarly, an unlawful sale occurs if the vehicle was not sold fairly or if the lender failed to comply with the state’s sales laws. For instance, the lender must usually provide you with notice of the sale. If you prevail in a lawsuit, you might be able to recover damages, such as the value of the car or any financial losses you suffered due to the repossession.